Most Amazon sellers fail not because they have a bad product, but because they are "blind" to their competition. In 2026, the marketplace has evolved; simply tracking a few keywords isn't enough. You need to understand your competitor’s sales psychology, their supply chain gaps, and—most importantly—what their customers are whispering (or screaming) about in the reviews.

After testing dozens of specialized platforms, I’ve curated the 7 best Amazon competitor analysis tools to help you identify niche opportunities and protect your market share.

If you are in a hurry, have a look at the quick breakdown of my top picks.

Product | Best For | Key Strength |

VOC.AI | Customer Sentiment & Product R&D | Deep semantic review analysis and root-cause extraction |

Helium10 | All-in-One Growth Suite | Massive database for reverse ASIN lookups and SEO. |

Jungle Scout | Beginner-to-Mid Sellers | Highly accurate sales estimator and supplier database. |

Sellersprite | Global Validation & Efficiency | Deep cross-market validation and AI-driven safety checks. |

Keepa | Price & Rank Tracking | In-depth historical charts for stability analysis. |

SmartScout | Brand & Category Mapping | Identifying market share leaders and brand momentum. |

AMZScout | Budget & Arbitrage | Lightweight extension and simplified "Product Score" |

VOC.AI: Best for Deep Customer Sentiment & Product R&D

- Best for: Established brands, R&D teams, and product managers who need to understand why customers are buying (or returning) products.

- Why I Pick It: VOC.AI is the "Intelligence Engine" of my stack. While other tools might just give you a word cloud of reviews, VOC.AI acts as a semantic analyst. I specifically use it during the product development phase. For example, when I analyzed a competitor's headphones, VOC.AI didn't just say "bad quality." It grouped hundreds of reviews to reveal a specific root cause: "The charging port loosens after 3 months." This allows me to fix issues my competitors are ignoring before I even manufacture my first unit. It automates the "reading" of thousands of reviews, turning messy feedback into a clear R&D roadmap.

- Core Functionalities:

- Customer Profile & Usage Scenarios: It doesn't just read reviews; it builds a profile. It extracts demographics, usage contexts (e.g., "using at the gym" vs. "commuting"), and behavioral patterns directly from the text so you know exactly who you are designing for.

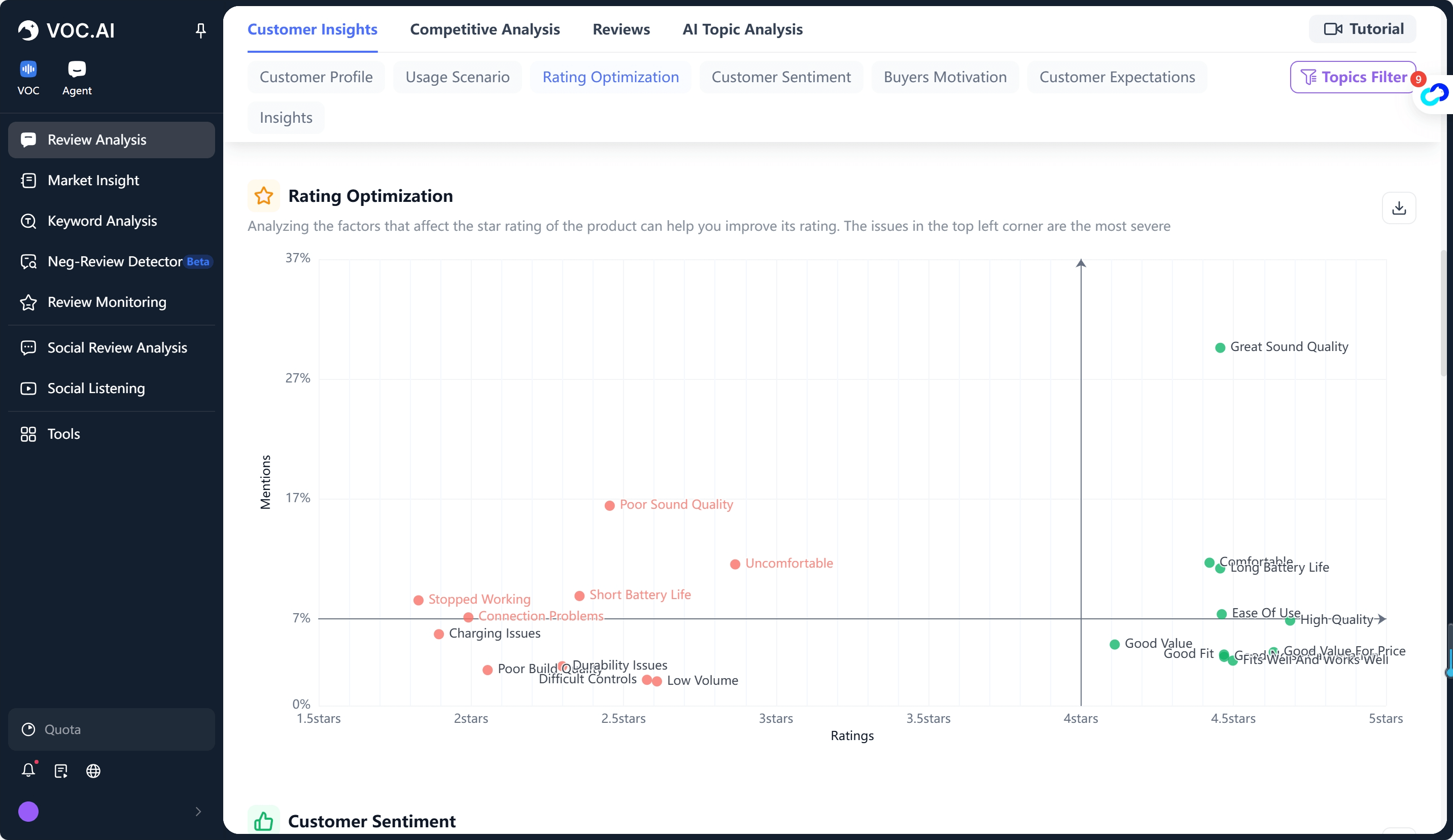

- Rating Optimization (The 4-Quadrant Model): A strategic visualizer that plots "Mention Frequency" against "Star Rating." It instantly separates critical threats (High Mention × Low Rating) from your key selling points (High Mention × High Rating), helping you prioritize fixes that actually save your score.

- Dimension-Based Pros & Cons: Automatically buckets messy feedback into specific technical dimensions—like "Sound Quality," "Battery Life," "Comfort," or "Workmanship"—with specific sentiment scoring for each.

- Purchase Motivation & Unmet Needs: Digs deeper to reveal the psychology of the sale—identifying the real reason users bought (e.g., "Cost-effectiveness" vs. "Brand Trust") and spotting the "gap" trends they are still asking for.

- Limitations:

- Requires a sufficient volume of reviews (100+) to generate the deepest insights for the persona modeling.

- Highly specialized; it is an analytics tool, not a keyword ranking tracker.

- Pricing:

- Free Plan: Basic access to AI review analysis features, ideal for beginners testing the waters.

- Pro Plan ($99/mo): For advanced product research. Includes 600 review analysis reports per month, market insights, and access to 10+ AI seller tools.

- Enterprise Plan (Custom): For large-scale businesses. Offers unlimited reports, API access for review analysis, and advanced AI listing optimization features.

Helium 10: Best for Reverse ASIN & SEO Mastery

- Best for: Professional sellers managing private label brands who need deep keyword data.

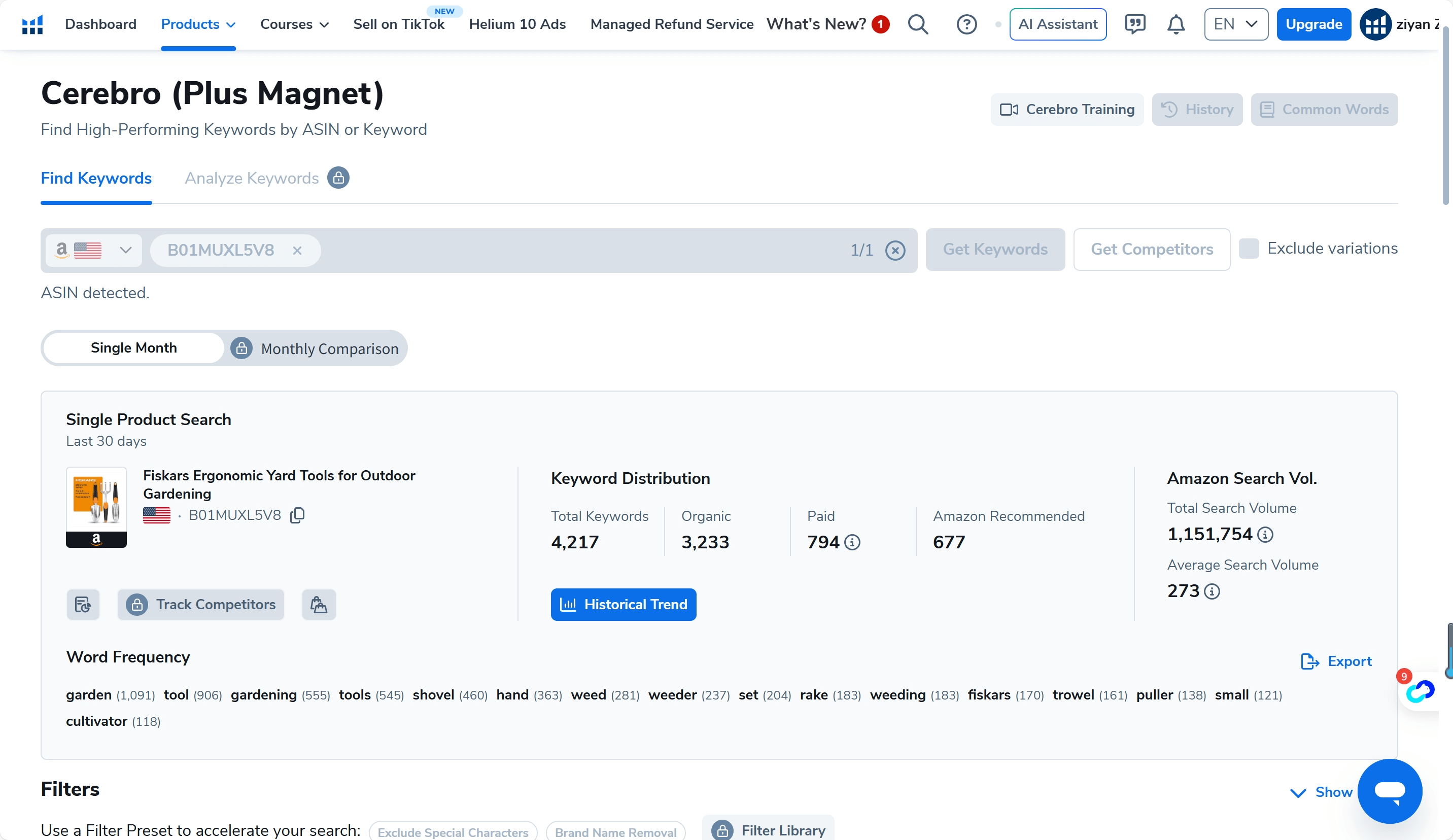

- Why I Pick It: Helium 10 remains the "gold standard" for SEO. I specifically use the Cerebro tool for Reverse ASIN lookups. It allows me to see exactly which keywords are driving 80% of my competitor's sales. In 2026, their Market Tracker 360 has become essential. It provides a bird's-eye view of market share shifts in real-time. If a new competitor suddenly spikes in sales, Helium 10 alerts me immediately, allowing me to adjust my PPC budget before I lose rank. It is the creative spark for my traffic strategy.

- Core Functionalities:

- Cerebro: The industry-leading Reverse ASIN lookup tool.

- Xray Extension: Real-time sales estimates while browsing Amazon search results.

- PPC Analytics: Break down competitor ad strategies and traffic share.

- Market Tracker 360: Monitors entire markets for share shifts and new entrants.

- Limitations:

- The feature set is massive, which can be overwhelming for beginners.

- Pricing is on the higher end for the full suite.

- Pricing:

- Free Plan: Good for testing basic features like Xray.

- Platinum Plan($129/mo): The standard for most sellers; includes all core research tools and AI advertising.

- Diamond Plan($359/mo): For experts scaling up; adds Walmart data and unlimited TikTok search.

Jungle Scout: Best for Market Size & Supplier Discovery

- Best for: Beginners to intermediate sellers looking for a clean interface and reliable data.

- Why I Pick It: Jungle Scout is my go-to for "Discovery." When I am just exploring a niche, their Chrome Extension gives me the fastest "pulse check" on market size and competition levels. But the real secret weapon is their Supplier Database. I use it to track exactly where a competitor is manufacturing their goods. By analyzing their import records, I can find their factory, see their shipment frequency, and even estimate their real sales volume based on container imports. It removes the guesswork from sourcing.

- Core Functionalities:

- Opportunity Finder: Spots high-demand, low-competition niches.

- Supplier Database: Uses customs data to reveal competitor manufacturers.

- Inventory Manager: Predicts restock dates to prevent stockouts.

- Review Analysis AI: Scans reviews for basic pros/cons summaries.

- Limitations:

- Keyword data is good, but sometimes less granular.

- The "Opportunity Score" should be used as a guide, not a rule.

- Pricing:

- Starter Plan($29/mo): Best for launching with industry-leading product and keyword research tools.

- Growth Accelerator($49/mo): Adds advanced research functionality and tools for growing sellers.

- Brand Owner($129/mo): The ultimate tier with unrivaled unlimited functionality and all Competitive Intelligence features.

Keepa: Best for Historical Price & Rank Stability

- Best for: Arbitrage sellers, wholesale analysts, and anyone who prioritizes data "truth."

- Why I Pick It: Amazon data is volatile; Keepa provides the history. I don't make a buying decision without checking the Keepa chart. It shows the "heartbeat" of a product over years, not just days. I use it to analyze Buy Box Statistics. It tells me if a competitor is dominating the Buy Box or if they are sharing it. In 2026, its ability to track price stability during events like Prime Day or Black Friday helps me understand the real baseline price of a niche, avoiding products that are only profitable during hype cycles.

- Core Functionalities:

- Price History Charts: Detailed tracking of price drops and rank spikes over years.

- Buy Box Statistics: See who owns the sale and for how long.

- Variation Analysis: Identifies which color/size sells the best on complex listings.

- Price Drop Alerts: Instant notifications when competitors lower prices.

- Limitations:

- The interface is utilitarian and looks like a stock market terminal (not beginner-friendly).

- Requires a paid subscription for the most critical data points (Sales Rank history).

- Pricing:

- Free: Basic price tracking (limited).

- Keepa Pro: Full data access.

SmartScout: Best for Brand Mapping & Wholesale Strategy

- Best for: Wholesalers and brands looking to identify "market gaps" across subcategories.

- Why I Pick It: While other tools focus on single products, SmartScout looks at the whole brand. I use its Traffic Graph feature to visualize where customers go after visiting a competitor's product. It’s like "stalking" a successful storefront to see their cross-selling strategy. It breaks down 43,000+ subcategories to show brand market share. This helps me find "soft" categories where one lazy brand holds 60% market share—a perfect target for disruption.

- Core Functionalities:

- Traffic Graph: Visualizes "Frequently Bought Together" and traffic flow.

- Brand Market Share: Top-down view of who dominates specific subcategories.

- Seller Map: Shows the geographic location of top sellers.

- UPC Scanner: Fast bulk scanning for wholesale lists.

- Limitations:

- Geared heavily towards Wholesale and Brand strategy, less for private label beginners.

- Traffic data is an estimate based on Amazon's recommendation engine.

- Pricing:

- Basic Plan($29/mo): Simple and reliable tools for finding profitable opportunities, including full access to the Brands and Products databases.

- Essentials Plan($97/mo): Adds advanced operations tools like the Seller Map and Keyword Rank Tracking for faster scaling.

- Business Plan($187/mo): The "Most Popular" tier for dominating a category; unlocks the critical Customer Traffic Networks (Traffic Graph) and Subcategories Database.

- Custom($399/mo): For enterprise research needing historical brand reports, competitor ad data, and Data Lake access.

SellerSprite: Best for Global Validation & Compliance

![]()

- Best for: Sellers operating in multiple global marketplaces who need strict validation.

- Why I Pick It: SellerSprite is exceptional for "Deep Validation" and efficiency. Before I commit to a product, I use their Design Patent check feature. It scans for potential IP conflicts, saving me from costly legal battles down the road. It also integrates seamlessly with the browser to overlay critical data (like ABA keywords and conversion rates) directly onto the Amazon page. It’s a cost-effective powerhouse for verifying if a niche is safe and profitable across different global sites.

- Core Functionalities:

- Design Patent Check: One-click screening for IP risks.

- Market Intelligence: Deep analysis of supply and demand ratios.

- Browser Extension: Immersive data overlay on Amazon search results.

- Keepa & BSR Integration: Displays historical trends directly in the search results.

- Limitations:

- Interface can feel dense with data.

- Some advanced features require a learning curve to interpret correctly.

- Pricing:

- Basic Plan($39/mo): Good for basic research; includes AI Listing Builder and Sales Estimator.

- Standard Plan($79/mo): The most popular option; unlocks tracking for 100 products and 500 keywords.

- Advanced Plan($129/mo): For growing businesses; increases tracking limits to 300 products and 1,000 keywords.

- VIP Plan($189/mo): For power users needing maximum data volume (500 products / 2,000 keywords).

AMZScout: Best for Budget-Friendly Quick Validation

- Best for: Beginners, dropshippers, and arbitrage sellers who need a lightweight, affordable tool.

- Why I Pick It: Not everyone needs the "heavy machinery" of Helium 10. AMZScout is my go-to recommendation for sellers on a budget. It’s famous for its PRO Extension, which is incredibly lightweight and doesn't slow down your browser like some heavier suites. In 2026, it remains a favorite for "Arbitrage" and "Dropshipping" because it simplifies complex data into a single "Product Score" (1-10). If I'm scanning 50 products in an hour, AMZScout helps me filter out the junk instantly without getting bogged down in deep analytics.

- Core Functionalities:

- Product Score: A simple 1-10 rating predicting the success potential of a niche.

- Quick View: Instantly see BSR and FBA fees directly on the Amazon search page.

- Dropshipping & Arbitrage Filters: Specialized filters to find products with low competition and high margins.

- Stock Stats: Spies on competitor inventory levels to see how fast they are selling.

- Pricing:

- Monthly Plan($59.99/mo): Flexible access to the full AMZScout AI Bundle.

- Yearly Plan($399.99/year): The "Best Value" choice; includes 3 months free, a personal mentor call, and exclusive product ideas.

FAQ

- Why is competitor analysis critical in 2026?

Most sellers fail not because of bad products, but because they are "blind" to the competition. In 2026, simply tracking keywords isn't enough; you need tools that reveal sales psychology, supply chain gaps, and the "root causes" hidden in customer reviews to truly protect your market share.

- Which tool is best for beginners vs. established brands?

For beginners or arbitrage sellers, AMZScout and Jungle Scout offer the most intuitive "pulse checks" on market size and profitability. For established brands focused on R&D and market dominance, VOC.AI and Helium 10 provide the deep semantic and SEO data needed to outsmart sophisticated competitors.

- What features should I look for in an analysis tool?

When choosing a tool, look beyond simple sales estimates. In 2026, you should prioritize Semantic Analysis (to understand why customers buy), Historical Data Stability (to avoid hype cycles), and Supply Chain Visibility (to find factory sources).

- Should I use one tool or a stack?

The best strategy is often a "stack" of specialized tools working together. For instance, successful sellers often use Helium 10 for their SEO foundation, VOC.AI for deep customer sentiment analysis, and Keepa to monitor daily price fluctuations.