For decades, Amazon has maintained its status as the world’s logistics backbone, democratizing access to millions of everyday goods. While most consumers associate the platform with speed and affordability, a parallel universe exists within its digital aisles—a marketplace populated not by paper towels, but by rare numismatics, authenticated historical artifacts, investment-grade jewelry, and high-end living solutions.

This in-depth exploration guides you into Amazon’s high-value tier. Beyond mere price tags, we dissect the factors that allow a $200,000 coin or a $50,000 watch to be sold with a single click. It unveils how scarcity, provenance, and platform trust converge to meet the demands of the world's most pragmatic collectors.

The Anatomy of Expensiveness on Amazon

More Than Just Price: Defining 'Value'

The phrase “most expensive thing on Amazon” often triggers myths of billion-dollar yachts. However, the real high-end inventory on Amazon is defined by tangible value rather than internet lore. Expensiveness here is the result of a harmonization of specific value-creating factors:

- Brand Heritage &Authority:Authorized listings from heritage watchmakers and established jewelers that carry global price consistency.

- Rarity & Grading:For collectibles, value is driven by "Mint State" (MS) grading and population scarcity—items where only a handful exist in the world.

- Craftsmanship & Materials:The raw cost of VVS diamonds, 18K gold, or hand-loomed textiles that justifies a five-figure baseline.

- Asset Liquidity:Items like gold bullion or graded sports cards that hold investment value beyond their immediate utility.

How Amazon Facilitates High-Value Transactions

Infrastructure Over Concierge

Unlike traditional auction houses that rely on white-glove ceremony, Amazon facilitates luxury through standardized trust and logistical scale.

Central to this ecosystem is the A-to-z Guarantee and strict Seller Verification protocols. For high-ticket items, Amazon has replaced the need for "escrow" with a robust dispute resolution framework and Transparency codes that track unit-level authenticity. Furthermore, the evolution of Amazon Luxury Stores provides a gated, brand-controlled environment, ensuring that high-end goods are presented with the visual fidelity and detailed provenance documentation that discerning buyers demand.

The Most Expensive Things on Amazon in 2025: Detailed Exploration

High-Profile Categories: Where Luxury Thrives

1.Rare Numismatics & Philately (Coins and Stamps)

Contrary to popular belief, some of the most expensive items on Amazon are not cars or jewelry, but historical artifacts. The coin and stamp collecting categories host listings that rival specialized auction houses.

- Top Items:American Silver Morgan Dollar MS-65

- Price:$288,000

- Details: Minted between 1878 and 1921, this specific coin is prized for its "MS-65" grade, indicating near-perfect condition. Its value is driven by the extreme scarcity of surviving examples in this pristine state.

- Insight: Sellers in this category must provide high-resolution imagery to verify the "mint state" condition, as collectors demand visual proof before dropping six figures.

- Notable Mention: Queen Victoria Londres, Mexico Uncanceled Stamp ($241,000). A rare historical artifact from the 19th century, valued for its "uncanceled" status and scarcity

2.High-Stakes Sports Memorabilia

Amazon has become a surprising hub for authenticated sports history. This category features items with verified autographs and vintage provenance, attracting serious investors.

- Top Item: Almost Complete T206 Baseball Card Set

- Price: $284,090

- Details: A near-complete set from the iconic 1909–1911 T206 series (famous for the Honus Wagner card). The hefty price tag is justified by the sheer rarity of assembling so many cards from this vintage era in one lot.

- Key Listing: Michael Jordan Autographed Original Rookie Card ($99,999). A 1996 vintage piece. While listing quality varies, the combination of "Rookie Card" + "Verified Autograph" + "Michael Jordan" creates a "Holy Grail" item for modern collectors.

3.Luxury Living & Unique Structures

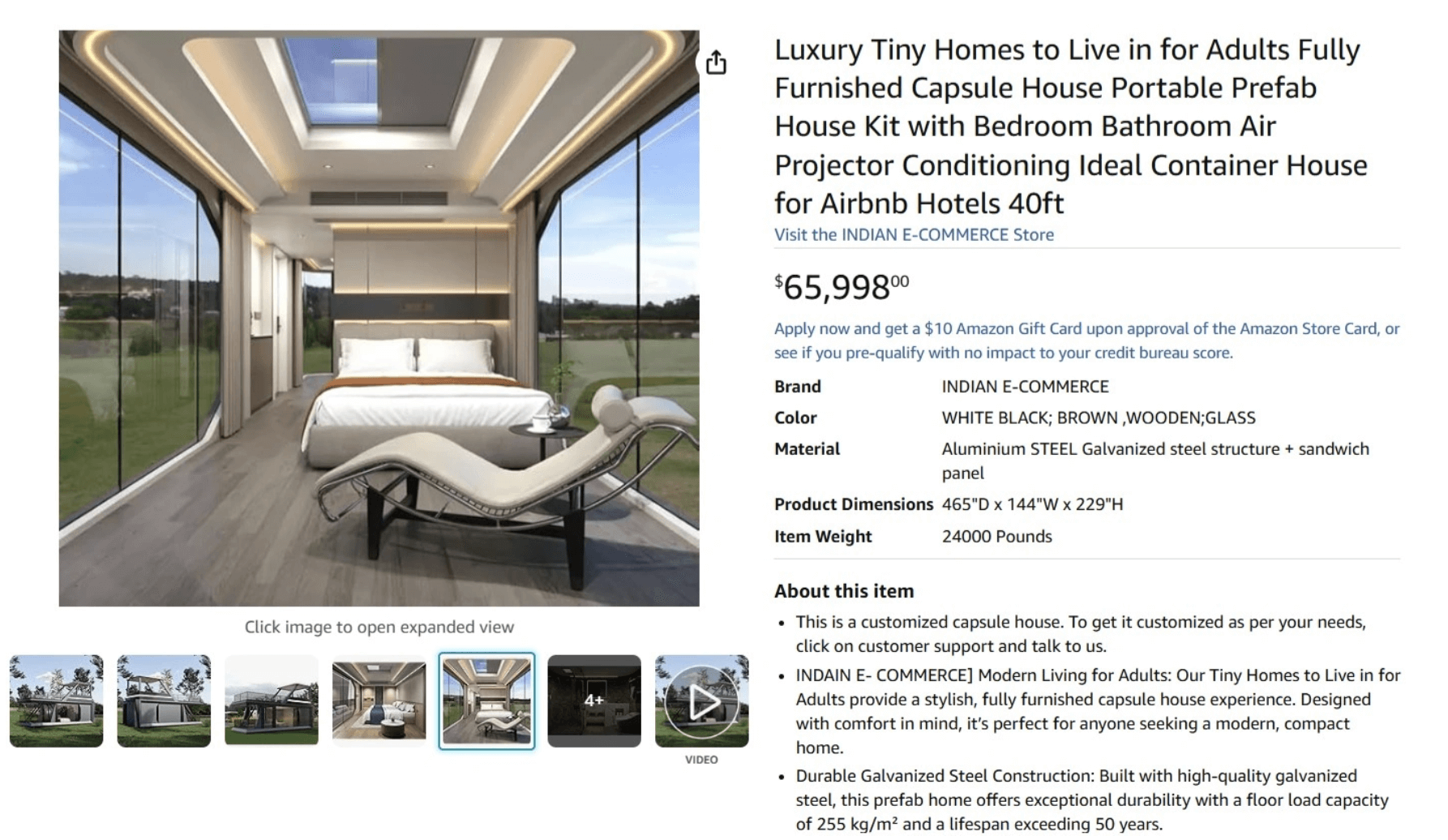

The "Tiny Home" movement has met the luxury market on Amazon. These aren't just garden sheds; they are fully equipped, high-tech living solutions shipped in containers.

- Top Item: Luxury Tiny Home (Portable Container)

- Price: $65,998

- Details: This isn't a standard prefab. It distinguishes itself with high-end inclusions like built-in air conditioning, a portable projector system, and luxury interior finishes.

- Why It Sells: It targets a specific niche of buyers looking for "instant luxury" for vacation properties or guest houses, combining shipping convenience with high-end specs.

4.Fine Watches & Jewelry

While not reaching the "multi-million dollar" myths, Amazon's luxury watch and jewelry segment offers genuine high-end pieces, typically sold by established dealers.

- Top Item: Rolex Day-Date Yellow Gold Champagne Dial

- Price: $48,595

- Details: A brand-new model featuring the iconic yellow gold finish. The listing emphasizes craftsmanship and the "Day-Date" prestige to justify the premium over standard retail channels.

- Jewelry Highlight: 14K Diamond White Gold Necklace ($37,390). Featuring VS1-VS2 clarity diamonds, this piece relies on technical specifications (clarity, cut, carat) rather than brand history to command its price.

5.Fine Art

Amazon's Fine Art category is a quiet contender for high-value transactions, connecting specific artists directly with global collectors.

- Top Item: Original Painting by Ryan Williams

- Price: $36,800

- Details: A large-format, one-of-a-kind artwork from the Caribbean.

- Value Driver: Unlike mass-produced prints, the value here is strictly in the "One-of-a-Kind" status and the artist's growing reputation. High-resolution photos showing brushwork texture are critical for these sales.

The Top 10 Most Expensive Items You Can Buy on Amazon (Actual 2025 Data)

Rank | Item | Price | Category | Why It's Expensive |

1 | American Silver Morgan Dollar MS-65 | $288,000 | Coins | Near-perfect MS-65 grade; rare numismatic treasure. |

2 | T206 Baseball Card Set (Near Complete) | $284,090 | Memorabilia | Vintage 1909-1911 series; extreme rarity of a full set. |

3 | Queen Victoria Mexico Uncanceled Stamp | $241,000 | Stamps | 19th-century history; rare "uncanceled" condition. |

4 | Frank Chance Autographed Baseball | $178,175 | Memorabilia | Hall of Famer signature; early 1900s vintage. |

5 | Michael Jordan Autographed Rookie Card | $99,999 | Memorabilia | Legend status + Verified Autograph + Rookie vintage. |

6 | Luxury Tiny Home (Portable) | $65,998 | Home | High-tech inclusions (A/C, Projector) & luxury finishes. |

7 | Rolex Day-Date Yellow Gold | $48,595 | Watches | Iconic brand prestige; Gold material value. |

8 | 14K Diamond White Gold Necklace | $37,390 | Jewelry | High clarity diamonds (VS1-VS2); precious metals. |

9 | Original Painting by Ryan Williams | $36,800 | Fine Art | One-of-a-kind status; large format original. |

10 | Electric Luxury Recliner | $26,798 | Furniture | Advanced vibration/comfort tech; premium leather build. |

What Drives the Price of Amazon’s Most Expensive Items?

Key Value Drivers

1. Certified Condition & Grading (The "MS-65" Standard)

For collectibles like the Morgan Dollar ($288,000) or the Action Comics, value is strictly tied to professional grading. A generic "good condition" isn't enough; sellers must provide third-party certification (e.g., PCGS for coins, PSA for cards) to prove a specific grade (like MS-65). In this tier, a single point difference in grading can swing the price by six figures.

2. Completeness and Set Value

As seen with the T206 Baseball Card Set ($284,090), the "Sum of the Parts" principle applies. Buyers pay a massive premium for the convenience of acquiring a nearly complete, curated collection in a single transaction, rather than hunting down individual pieces over decades.

3. Material Mastery & Brand Heritage

For items like the Rolex Day-Date ($48,595) or Chanel Bag, the price is justified by two factors:

- Material Cost: The use of tangible high-value materials (18K Gold, VVS Diamonds, Patent Leather).

- Resale Stability: Heritage brands like Rolex and Chanel maintain high resale values, making them safer "investment assets" compared to unbranded luxury goods.

4. Listing Fidelity and Visual Proof

Amasty's analysis highlights that high-priced items fail if they have "lackluster descriptions." Successful high-ticket listings (like the $36k Painting) require "High-Fidelity" presentation: high-resolution imagery of brushstrokes, video proof of functionality (for the Tiny Home), and detailed provenance documentation to bridge the digital trust gap.

Psychological and Market Factors

Veblen Goods and the Luxury Buyer Mentality

The "Halo Effect" of Luxury Listings Why do sellers list a $241,000 Stamp even if it rarely sells? These items serve as "Anchor Products." They signal to visitors that the store is a serious, professional establishment. Even if the customer can't afford the $241,000 stamp, the prestige of that listing gives them the confidence to buy a $500 item from the same seller.

Discoverability via Specificity Unlike generic goods, high-value items rely on Long-Tail SEO. Buyers don't search for "expensive coin"; they search for specific terms like "1893 Morgan Dollar MS-65". Successful sellers optimize their titles and descriptions with these precise technical keywords to capture the highly specific intent of wealthy collectors.

The Top 10 Most Expensive Items You Can Buy on Amazon in 2025

1.American Silver Morgan Dollar (MS-65 Grade)

- Price: $288,000

- Category: Rare Coins (Numismatics)

- Why It’s Expensive: This isn't just an old coin; it is a pristine example minted between 1878–1921. The value is entirely driven by its "MS-65" (Mint State) grading certification. In the world of numismatics, a coin in this near-perfect condition is exponentially rarer than a circulated one, justifying the quarter-million-dollar price tag for serious investors.

2.Almost Complete T206 Baseball Card Set (1909–1911)

- Price:$284,090

- Category: Sports Memorabilia

- Why It’s Expensive: The T206 series is the "Holy Grail" of baseball card collecting (famous for the Honus Wagner card). This listing commands a high price not just for a single card, but for the completeness of the set. Acquiring this many vintage cards from the early 20th century in one transaction is a massive convenience for high-net-worth collectors.

Amazon.com: 1909-11 T206 Almost Complete Set (Baseball Set) VG/EX : Collectibles & Fine Art

3.Queen Victoria "Londres, Mexico" Uncanceled Stamp

- Price:$241,000

- Category: Philately (Stamp Collecting)

- Why It’s Expensive: A piece of 19th-century history. Its value comes from two factors: its historical provenance (Queen Victoria era) and its "Uncanceled" status. Stamps that were never used or marked are significantly scarcer, making this a museum-grade asset available for direct purchase.

4.Frank Chance Autographed Baseball

- Price:$178,175

- Category:Vintage Sports Memorabilia

- Why It’s Expensive: Frank Chance was a legendary Hall of Famer from the early 1900s. Unlike modern players who sign thousands of items, a verified signature from this era on a preserved baseball is an incredibly rare find, backed by rigorous Certificates of Authenticity (COA).

5.Michael Jordan Autographed Original Rookie Card (1986/1996)

- Price:$99,999

- Category:Modern Sports Collectibles

- Why It’s Expensive: This item hits the "Trifecta" of value drivers: Legend Status (Jordan), Rookie Era (Vintage), and Verified Autograph. It represents the gold standard of modern sports investing.

6.Luxury Portable Tiny Home (Container House)

- Price:$65,998

- Category:Home & Garden / Modular Housing

- Why It’s Expensive: This is the most expensive "functional" item on the list. Unlike collectibles, this price covers high-end utility: a fully furnished, weather-resistant living structure equipped with air conditioning and a portable projector system, delivered via flatbed truck.

7.Rolex Day-Date Yellow Gold (Champagne Dial)

- Price:$48,595

- Category:Luxury Watches

- Why It’s Expensive: A "Hard Asset." The price reflects the tangible value of the 18K Yellow Gold material and the global liquidity of the Rolex brand. Unlike other items, this price is closely tethered to the global market rate for this specific model.

Amazon.com: Rolex Day-Date 18k Yellow Gold 40mm M228238 : Rolex: Clothing, Shoes & Jewelry

8.14K Diamond & White Gold Necklace

- Price:$37,390

- Category:Fine Jewelry

- Why It’s Expensive: Pure material cost. The listing emphasizes VS1-VS2 clarity diamonds, placing it far above standard retail jewelry. It targets buyers looking for wearable wealth rather than brand premiums.

9.Original Painting by Ryan Williams

- Price:$36,800

- Category:Fine Art

- Why It’s Expensive: One-of-a-kind exclusivity. Unlike a print or reproduction, this is a large-format original canvas. The price is driven by the artist's reputation and the guarantee that no other copy exists in the world.

10.Electric Luxury Leather Recliner

- Price:$26,798

- Category:High-End Furniture

- Why It’s Expensive: The peak of home comfort technology. This isn't just a chair; it’s a complex machine featuring advanced vibration motors, heating elements, and premium leather upholstery, priced for the ultra-luxury home theater market.

Buyer Psychology: The Logic Behind the High-Ticket Spend

Who spends $288,000 on a coin or $65,000 on a tiny home via a digital cart? The Amazon high-end buyer of 2025 is not looking for the champagne service of a physical boutique. They are Pragmatic Collectors, Time-Poor Professionals, and Institutional Buyers who prioritize speed and security over ceremony.

Real Market Insights: Why They Click "Buy Now"

1. The "Safety Net" Premium (Risk Mitigation) Contrary to the "white-glove" myth, the primary driver is actually Amazon’s A-to-z Guarantee.

- The Logic: Buying a $48,000 Rolex from a private forum or a standalone website carries risk. Buying it on Amazon provides a perceived safety net. If the item arrives differing from the "MS-65" grading description or lacks the promised GIA certificate, the buyer knows they have the leverage of Amazon’s customer-centric return policy. They are paying a premium for recourse.

2. Frictionless Acquisition (Speed over Ceremony) For the ultra-wealthy, time is the most expensive asset.

- The Logic: Purchasing a high-end item in a traditional gallery or dealership often involves appointments, negotiations, and social performance. Amazon allows a buyer to secure a $284,000 Baseball Card Set or a $26,000 Luxury Recliner in seconds, without the "concierge dance." It is the ultimate transaction efficiency.

3.The "Completionist" Collector

As seen with the T206 Baseball Card Set, Amazon serves as a hub for "Lot" purchases.

- The Logic: Serious investors use Amazon to fill specific gaps in their portfolios. Instead of hunting down 500 individual cards at trade shows over a decade, they utilize Amazon’s vast third-party network to acquire a near-complete collection instantly. The motivation here is asset consolidation.

4.Corporate and Institutional Procurement

Items like the $65,000 Portable Tiny Home or $36,000 Artworks are often not personal splurges but business expenses.

- The Logic: Small business owners and corporate buyers leverage Amazon Business accounts to purchase high-value assets (office expansion modules, lobby art) because it integrates seamlessly with their procurement software and invoicing systems—something a niche luxury vendor cannot offer.

Market Dynamics: How and Why High-Value Items Sell on Amazon

Selling a $288,000 coin or a $48,000 watch on a platform designed for toothpaste requires a different set of rules. In 2025, the market dynamics for ultra-luxury on Amazon are defined by strict gatekeeping, brand control, and audience scale.

1. Evolving Seller Strategies: The "Shop-in-Shop" Model

High-end brands historically avoided Amazon to protect their image. However, the maturation of Amazon Luxury Stores and Premium A+ Content has changed the game.

- Brand Control: Luxury vendors can now operate immersive, "gated" storefronts that separate their goods from general search chaos. This allows heritage brands and art dealers to control the visual narrative, ensuring a $30,000 necklace is presented with the same elegance as on a standalone boutique website.

2. Authenticity Infrastructure (The Real "Anti-Fraud")

Contrary to sci-fi rumors of "AI video checks," Amazon’s actual defense against fraud in the high-ticket sector relies on Integration with Physical Standards.

- Third-Party Reliance: For the most expensive items (Coins, Sports Memorabilia, Diamonds), Amazon doesn't just trust the seller; it requires visible proof from industry-standard bodies (PSA, PCGS, GIA).

- Transparency Codes: The platform utilizes unit-level serialization (Transparency by Amazon) to prevent counterfeits from entering the fulfillment chain, a critical factor for selling high-value electronics and branded accessories.

3.Algorithmic "Sniper" Targeting

Amazon’s algorithm has evolved from simple "People who bought X also bought Y."

- High-Intent Matching: The engine now effectively identifies "High-Net-Worth Behavior." If a user frequently searches for investment-grade bullion or premium watches, the algorithm begins surfacing these "hidden" six-figure listings in their recommendations, effectively connecting niche sellers with deep-pocketed buyers who might never visit a specialized auction site.

4.The Competitive Edge: Why Sellers Choose Amazon Over Niche Auctions

Why would a coin dealer list on Amazon instead of a specialized site like Heritage Auctions?

- Unmatched Reach: Platforms like 1stDibs or Chrono24 have targeted audiences, but Amazon has global traffic. A rare stamp listed on Amazon is exposed to millions of potential investors—including "new money" buyers who trust the Amazon ecosystem but are intimidated by traditional auction houses.

- Logistics Scale: While third-party sellers often handle the insurance for shipping, they leverage Amazon’s marketing infrastructure to find buyers in markets they could never reach physically.

Real User Scenarios: Why Buyers Choose Amazon for High-Ticket Items

Scenario 1: The "Points-Maximizing" Investor

- The Item: Graded Numismatics (e.g., $50,000+ Rare Coins) The User Logic: Smart investors often prefer Amazon over specialized auction houses for one specific financial reason: Credit Card Rewards.

- The Reality: "I purchased a certified MS-65 Morgan Dollar on Amazon not just for the coin, but for the leverage. By using my business credit card, I secured 5% cash back and buyer protection points on a $30,000 transaction—a benefit I wouldn't get paying via wire transfer at a traditional auction."

- Key Driver: Financial efficiency and utilizing Amazon as a vehicle for high-spend reward accumulation.

Scenario 2: The "Data-Driven" Jewelry Buyer

- The Item: GIA-Certified Diamond Studs ($20,000 - $40,000) The User Logic: For many, the traditional jewelry buying experience (high-pressure sales, obscure pricing) is intimidating. Amazon offers an analytical alternative.

- The Reality: "I chose to buy the diamond necklace on Amazon because I could download the GIA certificate and analyze the clarity/cut specs in peace, without a salesperson breathing down my neck. It was a purely data-driven decision, backed by the safety net of a 30-day return window if the item didn't match the paperwork."

- Key Driver: Privacy and Comparison. The ability to vet high-value assets objectively without social pressure.

Scenario 3: The "Instant Infrastructure" Business Owner

- The Item: Modular Housing / Luxury Tiny Homes ($20,000 - $65,000) The User Logic: Business owners in the hospitality or rental sector use Amazon for speed.

- The Reality: "We needed an extra guest unit for our Airbnb property immediately. Traditional contractors quoted 6 months. We ordered a pre-fabricated container home on Amazon, and it was delivered via freight in 3 weeks. The transaction was seamless because it went through our corporate Amazon Business account."

- Key Driver: Speed of Deployment. Turning a complex construction project into a simple "Add to Cart" logistics transaction.

The Risks and Realities of Buying the Most Expensive Things on Amazon

Authenticity: The "Grading" Gap

- The biggest risk for high-value collectibles on Amazon isn't necessarily a fake product, but a misrepresented grade.

- The Reality: In the world of coins and sports cards, the difference between an "MS-64" and "MS-65" grade can mean a $20,000 price swing.

- Buyer Caution: "Robust verification" often relies on the seller's provided paperwork. Experienced buyers stress that for any item over $5,000, the listing must include high-resolution photos of the third-party certification number (e.g., PSA, PCGS, or GIA) which can be cross-referenced on the certifier's official website before purchase.

Logistics: It’s Not Standard Prime

- Don't expect a $40,000 watch to be left on your porch like a bag of dog food.

- Signature & Insurance: High-value shipments trigger specific carrier protocols. They require an Adult Signature (21+) and often involve third-party shipping insurance purchased by the seller.

- No "Locker" Returns: Returning a six-figure or five-figure item is complex. You cannot simply drop a $30,000 diamond necklace at a Whole Foods return kiosk. These returns often require pre-authorization, documented packaging (video evidence of packing is recommended), and specialized insured shipping labels to ensure the item makes it back to the seller safely.

The "Limit" of Protection

- While Amazon’s A-to-z Guarantee is powerful, it has specific terms for high-value items.

- The Reality: Buyers should be aware that for extremely high-value transactions (marketplace sellers), the standard automated refund processes may pause for a manual investigation. The "instant refund" culture of Amazon shifts to a "verified claim" process when the price tag hits the thousands, designed to protect both the buyer and the seller from fraud.

The Future of Ultra-Luxe Shopping on Amazon

The trajectory of Amazon’s high-ticket marketplace isn't about selling billion-dollar paintings; it’s about using technology to bridge the trust gap for $50,000 transactions.

Trends Driving the Next Generation

1. Digital Product Passports (Beyond NFTs)

Moving past the hype of "NFT art," the real trend is Blockchain-Backed Provenance. Expect to see high-value collectibles (like watches and graded coins) come with immutable digital ledgers that track ownership history and authenticity, accessible directly through the Amazon order history. This effectively digitizes the "paper trail" required for asset-class investments.

2. AR as the New "Showroom"

Amazon is doubling down on Augmented Reality (AR) to reduce return rates for large items. Buyers can already virtually "place" a $5,000 sectional sofa in their living room or "try on" a luxury watch via their phone camera. As this tech matures, it will become the standard requirement for selling high-end furniture and art, giving buyers the confidence to checkout without a physical inspection.

3.The Rise of Luxury Livestreaming

Amazon Live is evolving into a powerful tool for high-end sellers. Instead of static listings, expect to see verified numismatists and jewelry experts hosting live, interactive showcases. This format mimics the engagement of a physical auction or QVC-style broadcast, allowing sellers to answer questions about a $20,000 diamond ring in real-time, building the human connection necessary for high-value sales.

Conclusion

Our exploration of the most expensive items on Amazon in 2025 reveals a marketplace that has evolved far beyond books and basics. It has matured into a trusted liquidity engine for tangible assets—from MS-65 rare coins to modular housing.

Key insights from analyzing Amazon's luxury offerings include:

· Multifactor Value Creation: The factors that drive ultra-high price tags—scarcity, authenticity, brand, and presentation—are harmonized by Amazon’s ecosystem of trust, scale, and logistics muscle.

· Trust over "White-Glove": The primary driver for high-value sales on Amazon isn't concierge service, but Standardized Trust. Buyers are willing to spend six figures because they rely on the impartial safety net of the A-to-z Guarantee and verified return policies.

· The Democratization of Access: Amazon has removed the "gatekeepers" of luxury. You don't need an appointment at a Swiss boutique to buy a gold Rolex, nor do you need to know a coin dealer to buy a Morgan Dollar. The platform offers immediate, judgment-free access to global inventory.

· Functionality Meets Collectibility: The list is split between Investments (coins, cards) and High-End Utility (tiny homes, commercial equipment). This proves that Amazon's high-end buyer is practical, not just ostentatious.

Recommendations :

· For Buyers:

- Verify the "Sold By": Always distinguish between "Ships from Amazon" and third-party sellers. For high-value items, prioritize sellers with a long, visible track record.

- Understand the "Restocking Fee": Unlike cheap items, returning a $50,000 watch often incurs a restocking fee or insurance deduction. Read the fine print before clicking buy.

· For Sellers:

- Invest in "Digital Proof": High-resolution images of certifications (PSA, GIA, PCGS) are non-negotiable.

- Leverage B2B: Don't ignore Amazon Business. Many high-ticket sales (like office pods or art) are corporate purchases, not personal splurges.

Final Thought: Amazon’s luxury tier is not about replacing Sotheby’s or Ferrari dealerships. It is about bringing efficiency and transparency to the high-end market. For the modern collector or investor, Amazon offers an unparalleled arena where rarity is just as accessible as a daily essential—proving that in 2025, the ultimate luxury is convenience.